oklahoma franchise tax form

Your payment amount is the same as your routing number account number or phone number. Click on the tab Links to Other Motor Vehicle Agencies at the top of this page for the Department of Public Safety the Oklahoma Tax Commission the Used Motor Vehicle Parts Commission or additional agencies that handle various motor vehicle related functions.

Gross Production 405 521-3251.

. Learn more about the benefits of selling your business to HR Block today. Tax preparers subject to the electronic filing mandate under LAC 61III1501 must file all extension requests electronically. Free printable and fillable 2021 California Form 540 and 2021 California Form 540 Instructions booklet in PDF format to fill in print and mail your state income tax return due April 18 2022.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Type of federal return filed is based on your personal tax situation and IRS rules. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

New Mexico has a state income tax that ranges between 17 and 49 which is administered by the New Mexico Taxation and Revenue Department. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to. Oklahoma Tax Commission Post Office Box 26920 Oklahoma City OK.

The DC franchise tax also known as the DC unincorporated business franchise tax is a tax imposed on some businesses operating in the District of Columbia that have gross receipts of 12000 or more. You can generally start to see a status four days after the Oklahoma Tax Commission receives your return. To add or change a location address fill out form BT-115-C-W and mail to.

How soon can I expect a response from the IRS after filing Form 3911. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

To make this election file Form 200-F. California state income tax Form 540 must be postmarked by April 18 2022 in order to avoid penalties and late fees. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return.

Ohio has a state income tax that ranges between 285 and 4797 which is administered by the Ohio Department of Taxation. Health Adventure Gear Style. TaxFormFinder provides printable PDF copies of 81 current New Mexico income tax forms.

In some states companies with operations in that state may also be liable for the. Safety measures are in place to protect your tax information. You can check the status of your Form 1040-X Amended US.

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under. Your data is secured with SSL Secure Socket Layer and 128-bit encryption. Your annual LLC tax will be due on September 15 2020 15th day of the 4th month.

Corporations that remitted the maximum amount of franchise tax for the preceding tax year or that had their corporate charter suspended do not qualify to file a combined income and franchise tax. The unincorporated business franchise tax Form D-30 must be filed by any DC. A tax levied at the state level against businesses and partnerships chartered within that state.

Submitting a copy of your federal paper extension Form R-4868 Application for Automatic Extension of Time to File US. Interested in selling your tax business. Account Maintenance 405 521-4271.

Contact the Franchise Tax Board if you have not heard anything within one month of filing an electronic return two months if you paper file. You form a new LLC and register with SOS on June 18 2020. We would like to show you a description here but the site wont allow us.

Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. To get a New Jersey Tax Clearance Form you can first register with the NJ Premier Business Services.

Paper filings will take longer and you should wait about three weeks before you start. Individual Income Tax Return using the Wheres My Amended Return. Use FTB 3522.

Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return. With corporate franchise tax collection these tax revenues are the most volatile. Set us as your home page and never miss the news that matters to you.

Individual is the type of return in item 7 2020 is the tax period and date filed should be left blank. After registering log in go to the Tax. When the economy goes into a recession corporate profits drop and franchise tax revenues also drop.

Form 3911 needs to be signed and must be signed by your spouse if you filed a joint tax return. Oklahoma Tax Commission Division Phone Numbers. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Individual Income Tax Return. The Oklahoma franchise tax is mandatory for all for-profit corporations including S-corporations partnerships and limited liability companies organized and maintained in Oklahoma. To make this election file Form 200-F.

Rural Electric Co-Op License. Get 247 customer support help when you place a homework help service order with us. 5 - February 28 2018 at participating offices to qualify.

Find the latest sports news and articles on the NFL MLB NBA NHL NCAA college football NCAA college basketball and more at ABC News. Franchise Tax 405 521-3160. Gross Production Lease Records.

You can expect a response within 6-8 weeks of filing Form 3911. Business that is unincorporated which includes partnerships. Many states do not release their current-tax-year 2021 tax forms until the beginning of the following year and the IRS releases federal tax forms for the current year between May and December.

You can change your filing date by filing Form 200-F Request to Change Franchise Tax Filing Period by mail or online using OkTAP. To download or print PDF versions of the tax forms you need choose your state from the map or list below. TaxFormFinder provides printable PDF copies of 83 current Ohio income tax forms.

To register your account with OkTAP you will need the following information. For example in 2007 which was considered an expansion year.

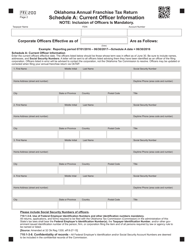

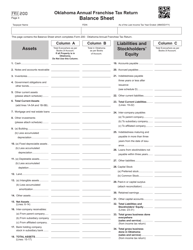

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

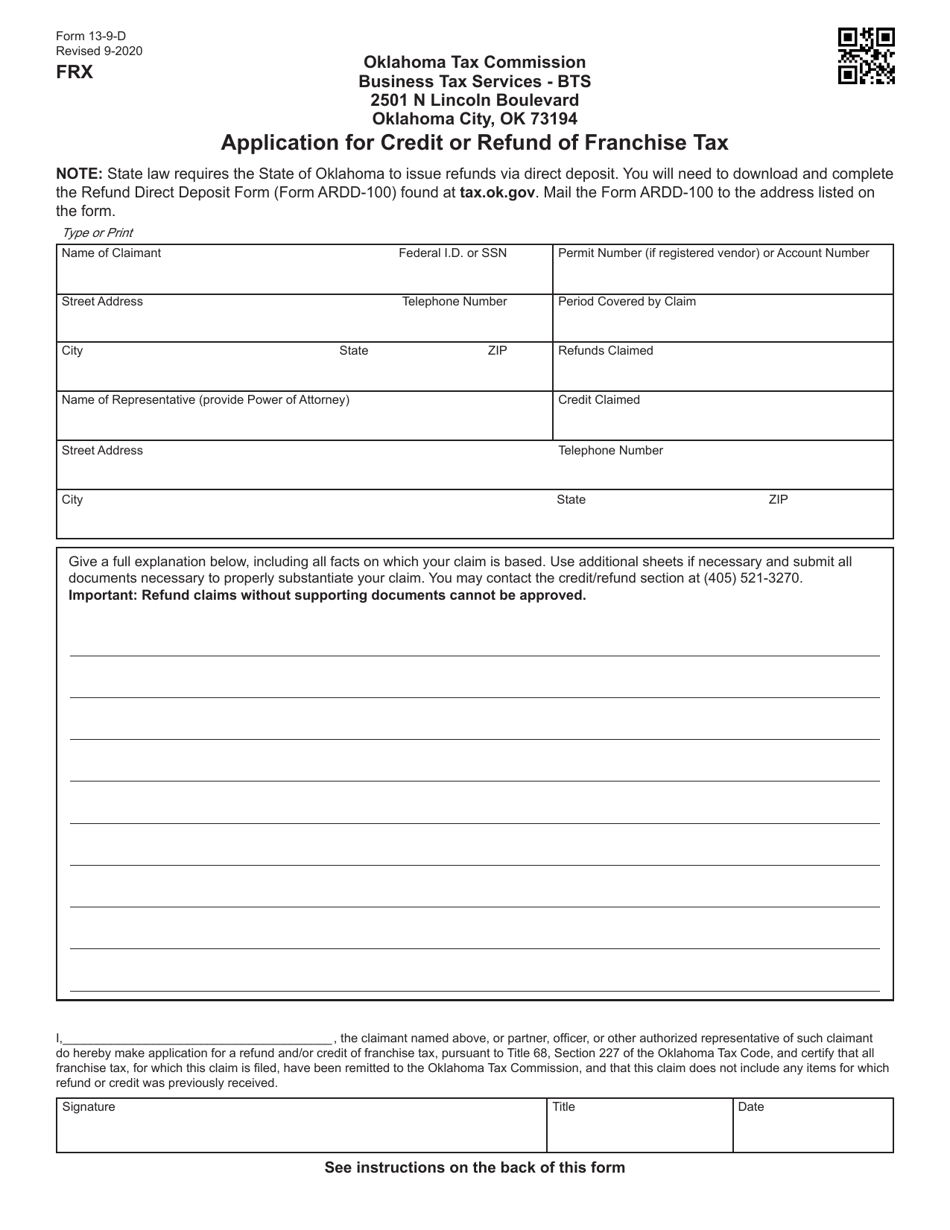

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

State Corporate Income Tax Rates And Brackets Tax Foundation

Start A Nonprofit In Oklahoma Fast Online Filings

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Opinion To Overcome Inflation Woes Oklahoma Must Lower Tax Rates

3 10 72 Receiving Extracting And Sorting Internal Revenue Service